What is leverage in Forex Trading?

Contents:

Forex brokers are known to offer high leverage because the foreign exchange market is blessed with high liquidity. The concept that explains the use of someone else’s money to trade or enter an investment transaction is applied to forex markets as much as it is relevant to stock markets. However, in currency markets, the leverage you can use is higher, and this is a definite advantage. Still, like all things related to investment markets, you should be cautious of a “double-edged sword”. The use of derivatives on currency pairs, such as futures and options, is another way to trade in forex. Purchasing a futures contract generates an obligation to purchase the underlying currency pair at a predetermined point in the future.

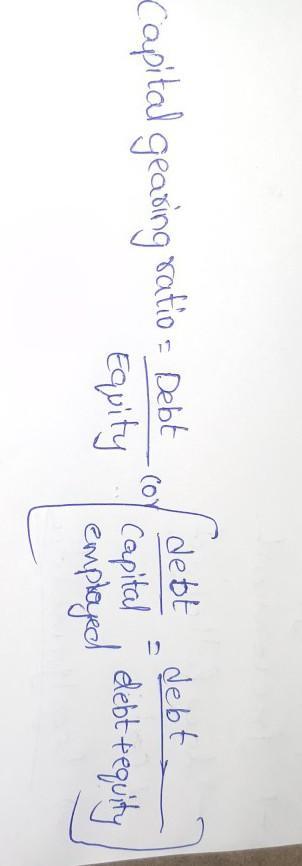

That is, scalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage amount. We’ve collated the leverage for all tradeable forex pairs in India. This is the forex trading with leverage that most people look for before choosing a trading opportunity or strategy. That means he can trade at 40X leverage by depositing a margin of Rs. 2,000.

Foreign Exchange is the process of changing one currency in to another currency for reasons such as trade, tourism, commerce etc. Foreign exchange is a global marketplace for exchanging currencies. Is it possible to travel to Countries like China, USA or Japan with Indian Rupees? Or else if India wants to Import Oil from Russia is it possible to make Remittance in Rupees? Because every country has its own currency and we need to make payments according to that only. Margin is money borrowed from your broker to purchase a security with the help of other securities in your brokerage account as collateral.

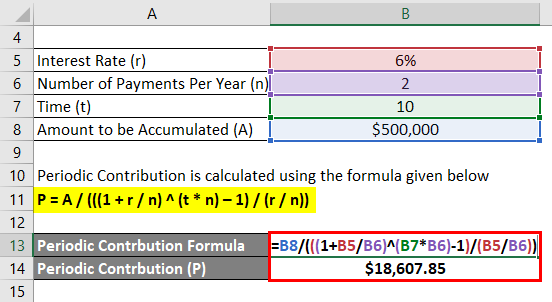

Trading volume in the market is an equally important factor to take note of while using leverage. You need to pay a minimum deposit amount while opening a margin account. The deposit amount ranges from $5 to $200 and above which varies from broker to broker. Alpari International has 20 years of forex industry presence with 2 million traders. Alpari is a brand name of Exinity Limited and is regulated by The Financial Service Commission – Mauritius. An AvaTrade margin account can be opened with a minimum deposit of $100 by paying in any of the four currencies .

And trader should not take losses in excess of 1-2 per cent of capital in a single trade. Brokers who offer negative balance protection save you from any debt payments. Under negative balance protection, the losses are restricted up to the initial deposit. To be trustworthy they need to be overseen by a major financial regulator having rigorous compliance on trading practices and client protection.

How to Use Stock Trading API?

Lexa trade is a chating company , I just opened with 250 USD and later due to unforseen i asked them to deposit back which they are not even bothered ,dont invest in this company at all all fraudesters. You would love my articles related to Credit Cards, Travel, Shopping, Tax Saving. I share transparently how I am making passive income from multiple sources online.

Forex vs crypto: what are the differences? – IG

Forex vs crypto: what are the differences?.

Posted: Thu, 04 Aug 2022 09:13:08 GMT [source]

The formality of these agreements and transactions ensures that the terms of the agreement or transaction are set in stone and cannot be modified. Future market transactions are preferred by traders that undertake large forex transactions and need a constant return on their holdings. In addition, there are education support and training programmes available. The forex brokerage houses are market participants who are regulated.

Zero Collateral Loans (CGTMSE)

Get investing insights from our indepth research tools and capabilities. This is the amount of money you receive when their account loses the capability to cover any more loss. Using them whimsically and randomly will destroy a trader’s career, account, and dreams. So, before engaging with them, make sure you have profound knowledge about them. Yes, it’s possible to make money with Forex trading, but it also involves significant risk and requires extensive knowledge and research.

- Because current assets are less profitable than fixed assets, this is the case.

- In case of failure to come across any boundary necessity, your situation may be settled and you will be accountable for any subsequent victims.

- The hazards include market volatility, leverage, and geopolitical events affecting currency values.

- Currency trading in India has risen dramatically as a result of liberalisation, which has given banks and enterprises more flexibility in holding and trading foreign currencies.

- QUOTEX Is good for fixed time trades and fast withdrawls.happy to use.

You can open an https://1investing.in/ with the minimum initial deposit of $100. The trading account can be funded using VISA, Master, Diners, Neteller, Jeton, Skrill, GlobePay and netbanking. The platform offers to trade CFDs in currencies, crypto, indices, shares, commodities and ETFs assets. New forex traders can copy trade real-time by following experienced traders using FXTM Invest. A standard lot is equivalent to 100,000 units of the base currency. Here the currency on the left is the base currency and the currency on the right is the quote currency.

Advantages & Disadvantages of Forex Trading

But most of the time, using leverage translates into enhanced loss that you cannot afford to pay back. As a beginner in Forex trading, it’s essential to understand what a Forex broker is and their role in the market. A Forex broker is a financial institution or individual who provides a platform for traders to buy and sell currencies in the Forex market. Forex brokers earn their income by charging a commission or a fee on each transaction their clients make. They play a crucial role in the Forex market because they provide access to the market and help traders execute their trades. If you’re a beginner and struggle to select a Forex broker, you should consider factors such as regulation, fees, trading platforms, customer service, and the broker’s track record.

That avails you of a tremendous amount of flexibility in your trades. Best forex brokers with high leverageis that we have one of the most impressive inter-bank liquidities. It is possible to avoid the negative impacts of forex leverage on your trading operations.

The big banks are some of the key participants in the forex market. One of the major risk involved in Forex market is fluctuations and forex trading requires leverage. If the trader is enjoying profits the situation goes ok but the scenario changes once the trader makes loss.

As mentioned, Forex brokers act as intermediaries between traders and the Forex market. They offer their clients access to the market by providing a trading platform, tools, and services needed to execute trades. First, they provide their clients with trading platforms that allow them to execute trades in the Forex market. Traders place their orders through the broker’s trading platform, and the broker facilitates the transaction by matching the order with a counterparty in the market.

AXIS BANK COUNTRY WEBSITE

Other than Forex, leverage can be used in cryptocurrency, stocks, index markets. A common way traders use leverage in crypto market is to increase their capital’s liquidity. Using leverage to keep the same position with lower collateral, allows traders to put their assets to a better use, for instance trading other decentralized assets. To understand how leverage works in the cryptocurrency market, you first need to knowWhat is Leverage in Crypto Trading. On the other hand, forex trading leverage is expressed as a ratio.

Introduced by the Reserve Bank of India and developed by the Clearing Corporation of India Ltd. , FX-Retail is an electronic trading platform for retail banking customers to buy and sell foreign exchange. The margin amount is used by the broker to sustain and maintain the market participant’s position. They merge an individual’s margin deposit with many others’ similar deposits. Eventually, the broker uses all this to place trades into the interbank network.

Ideally most powerful social media marketing strategy for 2020s avoid giving high leverage but Samco provides as high as 100x leverage in intraday. To aid your wealth creation journey, we have separately covered the top 10 tips for forex trading in India. While forex leverage is a boon when the markets are in your favour, they soon become a nightmare when the markets move against you. There is no fixed formula for selecting the best leverage ratio. It depends on your risk profile, how much capital you want to risk and how much volatility you can handle. Leverage in forex trading is expressed as a percentage or “X” of your deposit.

Add Comment