What Is An IOLTA Account? The difference between IOLTA and Attorney Trust

Contents:

It’s also worth noting that a lawyer is always on the hook for misusing funds from an IOLTA, even if the mistake is made by a bookkeeper or paralegal. Explicitly, IOLTA applies only to funds that are “nominal in amount or held for a short period of time”. So larger amounts of money held for single clients are exempt from the IOLTA program.

That means, typically, that client funds eligible for IOLTA involve small amounts of money held for a long time, or significant amounts of money held for a short time. As was the case prior to IOLTA, lawyers must exercise their discretion in determining whether a given client’s trust deposit is of sufficient size or will be held for sufficient duration to justify the cost of being individually invested for a client. In fiscal year 2021, interest on IOLTA accounts totaled more than $7 million.

Tips for Handling IOLTA Accounts

The program faced opposition in the U.S. because of a rule already in place stating that an attorney should never earn interest on a client’s money. Now banks will allow IOLTA checking accounts to earn interest and that interest goes straight to the IOLTA program. Our grants provide funding for free legal services to low-income people with civil legal problems, improvement in the administration of justice and education about the law. All lawyers must comply with Maryland’s IOLTA law, but compliance does not necessarily require having an IOLTA account. You must open an IOLTA account if you are holding short-term or nominal trust funds of at least $3,500 on a regular basis.

Russian Oligarch Associate Indicted Over Southampton Mansion – Dan’s Papers

Russian Oligarch Associate Indicted Over Southampton Mansion.

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

While some assume the interest on this money goes to the recipient, by law, it goes to an organization called the Connecticut Bar Foundation. The foundation uses the money to support nonprofit organizations that provide civil legal services to low-income people in Connecticut, as well as financial scholarships based on financial need. The IRS has ruled that the interest generated on these accounts is not taxable to the lawyer, law firm, or client.

Deposit Checks Immediately

If an attorney’s bookkeeper does not record the deposits and withdrawals promptly, the attorney can face severe consequences, possibly even losing their license. This is where a bookkeeping service that specializes in attorney trust accounts can be very beneficial. The idea for using interest on small retainers began in Australia in 1964, then Canada, and soon after was adopted by Florida.

- Before IOLTAs, law firms had to hold any combined client funds in special checking accounts that could not earn interest.

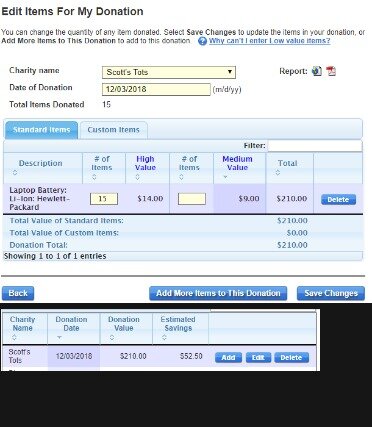

- Examples of client funds that may be appropriate to put in an IOLTA account include settlement checks, retainers and other fees advanced for services not yet performed, and funds related to real estate transactions.

- For most attorneys, it is a non-IOLTA trust account used for an individual client with a large balance held, such as payments for personal injury.

- This rule stated that the sole beneficiary of the interest on the accounts must be the Nebraska Lawyers Trust Account Foundation and these accounts must be readily available for withdrawal.

- A lawyer or law firm may decline (or opt-out) to participate in the program by filing a Notice of Declination with the Nebraska Supreme Court by February 15 of each year.

Additionally, IOLTA transactions should be recorded the moment they happen to avoid anything from slipping through the cracks. Keeping business and trust accounts separate is simply the only way to reduce your IOLTA compliance risk. However, as many state bar associations have specific requirements for establishing and administering IOLTAs and other legal trust accounts, it’s always best to consult an expert. Legal accounting is notoriously tricky and, truthfully, not enough time is spent training attorneys on the various intricacies that go into correctly managing their finances. But in the end, mishandling an IOLTA trust account, even as the result of an honest mistake, can irrevocably damage your reputation and erode client trust.

IOLTA Basics for Financial Institutions

Some firms will also intentionally use their IOLTA accounts to hide assets, or will leave funds in their IOLTA even after they’ve been earned, using it as a “savings” account. Regardless of how your law firm does its accounting, the system that you use to keep track of an IOLTA account must conform to the principles of double-entry accounting. The Current Year’s Reporting Attorney will make the update by completing 2a and selecting 2b which will indicate them as the firm’s reporting attorney. They will then proceed to select the appropriate IOLTA compliance certification for the firm within the same report. The Oklahoma Bar Association Legal Ethics Committee has offered advisory opinions on how attorneys should handle fees.

Before this legislation, client funds could not be held in banking accounts that were set up to bear interest. By taking the extra time to understand what an IOLTA is, best practices, and the available tools for managing them – your law firm can ensure perfect compliance and spend more time focusing on serving your clients. They are all used to separate the client’s money from the regular business or operating account.

Platinum Leader Banks are financial institutions that go above and beyond eligibility requirements to ensure the success of the IOLTA program and increase funding for legal aid. Although the tax identification number of NC IOLTA will be assigned to all general trust accounts, the trust account and all checks should bear the name assigned by the lawyer/law firm to the account. The trust account and all checks must be clearly labeled as a “trust account” or drawn on a trust account. Lawyers may use identifying names on their accounts and checks, such as Real Estate Trust Account, General Trust Account, etc. The identifying account name may include the term IOLTA; however, it should be clear that the NC IOLTA program is not the fiduciary agent for the account. An IOLTA account is a separate trust account that attorneys in Connecticut must set up to hold funds from clients and third parties.

Will it take much lawyer time and money to be involved in participating in IOLTA?

IOLA’s current two-year grant cycle will provide $70 million in grants for providers of civil legal aid to low-income New Yorkers, furthering the goal of equal access to justice for all. No trust account, whether it is IOLTA or not, can be linked to an operating account to utilize the collected trust account balances to offset charges or fees attributable to operating accounts . But things can be quite different when a smaller client has provided a retainer for future services, but their situation is not one that warrants setting up a completely separate trust account for their case. In a situation such as this one, it is most prudent to place that client’s funds into a bank account with other such retainers that are only meant to be held for a short period of time. And, though a retainer fee doesn’t necessarily cover the total cost of the services that are expected to be rendered, it will serve as a way to secure a certain amount of an attorney’s time and resources in the future. Request and track IOLTA funds electronically with our Gravity Legal integration.

To confirm whether or not using them is required, it’s best to check in directly with your state bar association or a legal account expert. That said, given that an IOLTA raises money for a number of worthy causes, it’s almost always beneficial to use them. In the United States, lawyers are allowed to place client funds in interest-bearing lawyer trust accounts. In the 1980s, the Interest on Lawyer Trust Accounts program was first established in the U.S. In states with mandatory IOLTA participants, the lawyer must place client funds into a trust account and cannot withdraw the money until they have earned the fee.

encumbrance accounting NC financial institutions should use the remittance portal to upload their remittance reports or other documents.Contact NC IOLTA if the banks needs assistance with submitting remittance reports. Unlike the criminal justice system, people with civil legal problems are not guaranteed an attorney. From the abused woman trying to find safety for herself and her children to the elderly woman being unlawfully evicted from her home, civil legal aid exists to ensure that all people have access to the civil justice system. Your financial institution should have all the necessary paperwork ready for you to fill out. They will also be able to talk to you about what sort of requirements will be necessary from you, and what responsibilities they will be able to tackle in order to keep your IOLTA account in compliance with your state’s rules and regulations.

Before state laws and supreme court rules created IOLTA programs, trust funds pooled in this manner earned no interest. This is because trust accounts typically are checking accounts and, until the 1980s, checking accounts did not earn interest. In addition, these trust funds earned no interest because it is unethical for attorneys to derive any financial benefit from funds that belong to their clients. Traditionally, lawyers have been ethically bound to keep clients’ funds separated from their own in a separate trust account. In May, 1984, the Supreme Court of Nebraska amended the Code of Professional Responsibility, Disciplinary Rule 9-102, to allow for the establishment of interest-bearing client accounts. The Supreme Court Rule specifically authorizing the establishment of interest-bearing trust accounts for client funds was adopted.

IOLTA Frequently Asked Questions

As such, the lawyer or law firm should never receive a 1099 form for IOLTA interest. This method of account identification will allow the earned interest to be recorded annually in the name of the Foundation and not in the name of the lawyer/law firm. Known as IOLTA programs, the dollars that are generated from client funds held in an interest bearing trust account are used for different purposes in each state, depending on the laws surrounding that state’s program.

Trump PACs paid $2 million this year to law firms representing January 6 witnesses – CNN

Trump PACs paid $2 million this year to law firms representing January 6 witnesses.

Posted: Thu, 21 Jul 2022 07:00:00 GMT [source]

Ultimately, a client’s retainer check is not yet your money, and that money must be immediately accessible to them. IOLTAs are special accounts that earn interest for the IOLTA program which uses the money to provide legal services to people who otherwise couldn’t afford an attorney. Most of the United States have a requirement that every attorney maintain an IOLTA for small retainers. These programs are strict about how the funds are used, how they should be recorded, and how an attorney should handle the account. Under IOLTA, client funds that cannot earn net interest for the client are deposited in an interest bearing demand trust account.

They will select option 2a and use the “MD Bar Attorney Search” function to pick the name of the new reporting attorney. The institution could either place IOLTA accounts in the two different product categories, or simply apply the same tiered rate structure to the IOLTA product. The Foundation has also established a “Safe Harbor” interest rate provision as an alternative to the highest interest rate or dividend requirement described above. Our mission is to expand public education about our legal system and to provide assistance to those who wish to access the legal system, but do not have the financial resources to do so. The funds created by Missouri IOLTA accounts advance these goals by obtaining a fair return on otherwise idle funds.

Enrollment Requirements

Each August, each attorney will receive his or her Annual Registration Fee notification from the Clerk of the Indiana Supreme Court. The attorney must fully complete the appropriate section on the Clerk’s online Portal to indicate whether he or she has an active Indiana OLTA account or is exempt from participating. More than half of the states have mandatory or universal programs, and that number is expected to increase. The Connecticut General Assembly established the IOLTA program in 1984; today, every state in the country has an IOLTA program. There are IOLTA programs throughout ten Canadian provinces and three territories and all United States jurisdictions—including the District of Columbia, Puerto Rico and U.S. You’ll never again have to worry about an account being out of balance, or money being allocated to an account when it shouldn’t have been.

3 Tips to Simplify IOLTA/IOLA Account Management – Legal Reader

3 Tips to Simplify IOLTA/IOLA Account Management.

Posted: Mon, 26 Oct 2020 07:00:00 GMT [source]

The Connecticut Bar Foundation’s website has more information about IOLTA accounts. Since then, all 50 states and the District of Columbia have adopted IOLTA programs. This is the perfect example of when an IOLTA account should be established by your firm to cover these types of situations. Integrations LawPay is integrated into industry solutions to create an elevated legal software user experience. In some instances the provincial legislation and/or regulations which direct the foundations also prescribe specific funding formulas which are applied to the five mandates.

Interest on Lawyer Trust Accounts is a method of raising money for charitable purposes, primarily the provision of civil legal services to indigent persons, through the use of interest earned on certain lawyer trust accounts. The establishment of IOLTA in the United States followed changes to federal banking laws passed by Congress in 1980 which allowed some checking accounts to bear interest. The Florida Bar Foundation launched the first American IOLTA program in 1981.

Each state has its own rules and regulations for IOLTA accounts and most of the interest generated is used for civil legal services for those who can’t afford legal representation in that state. In instances where this is the case, it’s normal for a law firm to have a separate trust account set up for that individual client. Attorneys often handle their clients’ money; for example settlement checks, or advance payments for court costs or other expenses. If there is a large sum of money involved or held for a long time, an attorney can hold the client’s funds in an individual account, known as a Client Trust Account , and the interest earned will go to the client.

Add Comment