Lotsize Indicators and Signals TradingView India

Contents

Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Most major trading platforms offer a practice platform so that you can try your hands at trading without spending your hard-earned money. It would be a good idea to take advantage of such a platform so that you don’t waste money while you are on a learning curve.

The best technical and candlestick patterns and chart patterns work in the forex market. As the name suggests, Lot Size means the total amount of currency in a box and size means how big the book is, the bigger the number of boxes will be. You can Click Hereto know more about the meaning of lot size in derivative contract.

What Are PIPS In Forex | Calculate PIPS & Lot Size – Bazar Guru Ji

When trading a currency based on the dollar with this lot, you will profit or lose $10 for every pip fluctuation. This lot size is often only employed by seasoned traders when the price movement certainty measures are greater than 90%. Trading with this lot size is extremely dangerous because one poor decision could result in significant losses. It is advised to only use this lot size for a brief period of time. One of the unique features of exchange-traded futures in India is that they are standardized. One of the methods of standardizing futures and options contracts is through the prescription of minimum share lot size.

- The effective date is decided and all contracts get adjusted to the new lot size.

- For example, a trader is optimistic that the GBP/USD will touch 1.2940, but not very certain of the rate moving any further.

- Forex transactions can be performed by a broker or via an online trading platform.

- Keep in mind that brokers offer various leverage rates, which can go as high as $1 of equity for positions of $100.

- However, some experts also suggest waiting to see whether the breakout turns into an upward or downward market trend and then trading.

It may be possible that the rate may move further ahead or may not reach the limit to get the order executed. In options, you are purchasing the rights and need to exercise it or let the right expire before the set future time and date. Essentially, the higher the leverage, the higher is the level of risk involved.

How to Calculate the Correct Lot size?

One can compute the profit or loss in their trade using the lot size, but pip value is equally important because only pip movements determine the profit or loss. To avoid losing everything, one must be careful while selecting the lot size to trade with. The next lowest lot size is called a tiny lot, and it has a size of 10,000 units. The majority of traders that utilize this lot size for trading are skilled professionals who have a solid understanding of the market’s principles.

The GBP has high value due to its relative association to peers like USD. The USD has globally wide acceptance in trade and commerce. The U.S. Dollar is highly liquid and is the most traded currency having a pair with all the major currency difference between bungalow and villa across the world. High leverage is akin to borrowing large sums of an amount to take positions. Any adverse rate movement can ring in eroding large capital. The market order is executed immediately at the exchange rate currently available.

Conventionally, currency pairs are reflected in abbreviated form, separated by a slash. EUR/USD refers to a currency pair in which the euro is the base currency, and the U.S dollar is the quote currency. Forex trading, also known as FX trading or Currency trading refers to buying and selling of international currency pairs. The main aim of forex trading is to exchange one currency with another in the expectation that the prices would alter, i.e. the currency bought shall appreciate by value with the one sold. The lowest lot size of all is referred to as a nano lot, which consists of 100 units.

You get to trade unlimited in currency contract at ZERO transaction cost. If a trader sells currency speculating the decrease in the currency price it is known https://1investing.in/ as short positions. On the other hand is the trader speculates the rise in the price of currency and buys it to make a profit, it is known as long positions.

What is the most profitable trading strategy

“Neophytes have their work cut out for them,” says Enneking. “There are a plethora of long-time, highly skilled, very knowledgeable players in the space. You have a long learning curve to climb to feel comfortable and become successful in the sector.” Hope you have got a lot of information about Forex Pips, follow us for similar information and share this post with your relatives so that their knowledge can also increase. However, some experts also suggest waiting to see whether the breakout turns into an upward or downward market trend and then trading. This certificate demonstrates that IIFL as an organization has defined and put in place best-practice information security processes.

The exchange rates of forward and futures markets are speculated by the scenario in the spot market which is the primary forex market where the majority of the trades take place. Clients will be required to place fresh orders on resumption of trading. The Exchange and KSL shall not be responsible or held liable for any incidental, special or consequential damages including but not limited to loss of profit.

How Does Leverage Work in Forex Trading?

Many brokers provide micro lots, which are the second-smallest size of the lot. This lot is 1000 units in size, and when trading with this lot size on a currency based on the dollar, you will profit or lose 10 cents for each pip fluctuation. Since many brokers offer this lot size, newbies like to use it to reduce their losses. As previously noted, this size is ideal for long-term traders, and it is also recommended if you are unsure of how the market will fluctuate. Given these restrictions, Forex trading in India is quite small in comparison to those of developed markets. The standard lot, which contains 100,000 units, is the largest accessible lot in this market.

Currency derivatives are a good option to have in your investment portfolio. In order to start trading in currency trading, you need a demat account which you can open with a broker firm by submitting your KYC documents. Such forex trade is ideal for individuals as well as corporates who deal in export and import of goods or services. Forex trading can be done either by buying and selling currency pairs or by purchasing derivatives such as options and futures. 4) No need to issue cheques by investors while subscribing to IPO. Traders bring unique buying and selling styles to the table when it comes to transacting forex.

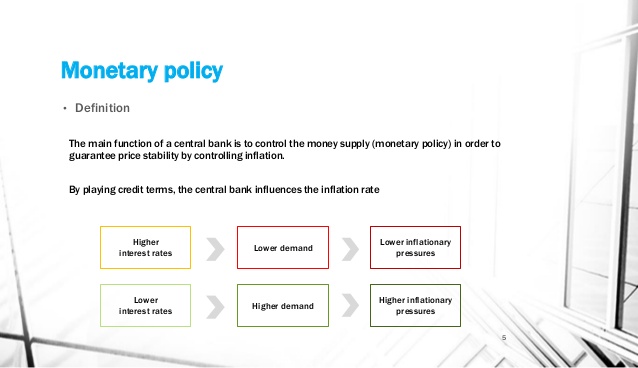

Hence, the biggest fluctuations in the forex markets result from these macroeconomic and geopolitical events. The higher interest rate tends to attract foreign investments, thus increasing the value of the home currency. Conversely, lower interest rates are unattractive for foreign investment and hence decrease the currency’s relative value. Another easy way to get the hang of the terms is to think yourself of visiting the forex market where banks and participants are ready to buy and sell currencies. To take a position at whatever exchange rate currently available in the market which is called the market order.

Whether you are a novice or need to reshuffle your understanding, here are some of the most frequently asked questions concerning the forex market. The Indian Forex market is regulated by SEBI and follows the ‘Forex Trading in India RBI Guidelines’. As per RBI’s Liberalised Remittance Scheme, an individual is not permitted to provide margin money for trading or use the money transferred abroad for speculative purposes. Forex trading in India is not allowed in cash for retail investors. In India, currency trading is facilitated on the National Stock Exchange, the Bombay Stock Exchange & the Metropolitan Stock Exchange of India Ltd. When you step into real-time forex trading after enough practice, starting small would be a wise idea.

What is Forex? Understanding the market for exchanging foreign currencies

During practice trading, you could learn from the mistakes so that you do not repeat them in real-time. Either way, if their bet is accurate, they will make a profit. However, if their prediction isn’t accurate, they will suffer a loss.

On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others. Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. The reverse logic applies in the case of stock price corrections. The point to note here is that since indicative lot values are fixed the individual lot sizes have to be continuously reviewed and modified based on the market price movements. That is why lot sizes differ across stocks and these lot sizes get modified over time.

Forex trading or forex exchange is the exchange of one currency for another. This exchange takes place at an agreed rate which is known as the exchange rate. A) Currency futures and options market trade from 9 AM to 5 PM, Monday to Friday. A) Minimum tick size is 0.0025p across all futures and options contracts. One can trade in the multiples of the above lots both in futures and options.

You need only two accounts, a forex trading account, and a bank account to start forex trading in India. After spending a few weeks reading all I could about Forex trading, I signed up with a broker from their list and opened a Demo trading account. This actually helped me a lot, allowing me to practice Forex trading without any risk. Once I was confident that I could manage a few small trades without risking too much, I opted for a live mini account with the same broker. The process itself is rather simple and everything is online.

The Forex market offers unmatched potential for profitable trading in any market condition or any stage of the business cycle. So, Ram made 170% profit in intraday, much higher than what mutual funds or stocks could offer. So, if you have Rs 10,000 in your forex trading account and your broker provides you a 10X leverage, then you can take positions upto Rs 1 lakh. Similarly, if your broker provides you a 50X leverage, you can trade up to Rs 5 lakhs.

Add Comment